Where does one begin the search to find new markets?

The good news is: new high-potential market opportunities are typically discovered closer-in than you would imagine. Some await discovery hidden in the clutter of your current customer list. Others find you, not the other way around. In either case, your task is to recognize and quickly assess their viability.

The biggest barrier is not that opportunities do not exist, but rather that firms have not dedicated a resource, and put in place the discipline to continually explore, vet and test their viability. New market opportunities can quickly and positively impact the bottom line. So, the key to growth is learning a) how to consistently be on the lookout, b) how to recognize possibilities and c) how to test their reality and viability.

Places for discovery:

Here are six places that have created the biggest up-sides for our clients.

- Current customer list: it’s the small customers, not the big ones

- Fulfilling customers’ unrecognized needs: the iPad and the SUV are good examples

- Your competitors’ current markets: they are not as homogeneous or impenetrable as you might believe

- Channel-to-market: is your channel providing more or less value to your customers than your customers need?

- The sales pipeline: most sales people are poor at assessing an opportunity for its real, bigger-picture potential

- International: some international demographics and economics are compelling

If you think you’ve already looked in these places, you might want to check again after reading this blog post.

Your small customers:

Some of the most significant growth opportunities we have seen have come from analysis of small, unexpected customers that have, under the radar, slipped into a firm’s customer list. They are typically considered insignificant and/or outliers for two reasons: 1) the revenue amount represented was relatively low and 2) they came from outside the primary market targets of the firm. However, a quick analysis in several cases revealed that these customers were actually representative of much larger markets – markets with large numbers of customers with the same significant unmet needs that were already being satisfied by the firms’ product lines better than any other offering available.

In one case, the small “insignificant” customer was representative of 20,000 similar organizations nationwide, none-of which had as good a solution to their problem as was being delivered by the firm’s software. This new market opportunity was tested and validated within 90 days. Growth over the next two years in that market more than doubled the company’s revenue

Well-known business thought-leader, Peter Drucker, in his book “Innovation and Entrepreneurship”, named this phenomenon “the unexpected success”. “Unexpected successes” are characterized by customers buying your product from markets you had not considered, getting benefits you had not conceived because your solution was inherently better than alternatives they had to consider.

This common dynamic means that someone in your firm should always be asking your “unexpected-success” customers these four questions:

- Why did you buy our solution?

- How many more people like you are there, out there?

- How many of those other people have a good solution now?

- Where do these people hang out?

The lack of a consistent asset dedicated to this analysis, delays the discovery of breakthrough new opportunities.

Your customers’ unmet needs:

The iPad, the SUV and the microwave oven are examples of new product ideas that were formulated to meet customer needs that were “subconscious” or simmering just below the surface of a customer’s “experience” with current solutions. The key words in this sentence are “subconscious” and “experience”.

Typically, in smaller companies, not enough time is dedicated to thinking about the subconscious needs of customers and the customer use experience. Most product development roadmaps we have seen are driven by; a) urgent responses to competitive moves, b) the drive to reduce product costs, and c) evolutionary feature extensions to current offerings. None of these create new market breakthroughs.

New market breakthroughs come from insights into customer behaviors, problems and product usage.

Your competitors’ current markets:

In the 1970’s GM (50%), Ford (25%) and Chrysler (15%) collectively owned 90% or more of the United States automobile market. Now some 40 years later, imports represent a huge portion of that same market. The lesson learned is that if you do not fragment your own market, a competitor will do it for you. The caveat: In each segment of the competitor’s market you target, you must have a relatively advantaged solution.

Imports won their initial US auto market share by fragmenting the US automaker’s markets and offering a value proposition that represented a significant value proposition improvement in one specific segment – the industry’s most vulnerable – small, economic compact cars. After establishing that foothold and clinching their quality reputation in the compact segment, they then stepping-stoned through the other segments – leveraging that quality reputation.

Your new market opportunity may simply be created through a focused initiative at a segment of your competitor’s markets that is most vulnerable due to that competitor’s neglect of the segment. This is particularly effective if the competitor is much larger. You should never attack a competitor on all fronts at once. However, all competitors are vulnerable to fragmentation and differentiation aimed at dissatisfied or under-satisfied customers in some sub-segment of their business.

Your channel to market:

Most firms decide on their channel-to-market based on what benefits it provides in market coverage. The market (customers) really only care about the services the channel provides to them – not the exposure it provides to the firm. If the channel is under-satisfying the needs of the customers’ this represents an opportunity for a) increasing value delivered and compensation received, or b) increasing market share based on service.

Amazon was launched as a channel alternative to brick and mortar book stores. It didn’t capture all book customers – but it did exploit a vulnerability and weakness of the then current book stores by offering convenience and in-home browsing. It created the on-line-bookstore market.

Your sales pipeline:

A sales person’s effort in pursuing an opportunity is typically influenced by three factors: a) the anticipated initial purchase amount, b) the magnitude of the long-term opportunity as communicated to the sales person by the customer’s purchasing department and c) the commission rate associated with the opportunity.

The first thing to recognize is that customer predictions of ultimate volume activity (part b above) are typically overstated – many times to hold up a carrot in order to exact the best pricing for whatever it is you are going to quote. More important than the volume prediction, is its logic. It should never be accepted at face value. Discovering the logic is what separates pursuit of a typical opportunity from discovery of a breakthrough market.

To test the validity and logic of a large prediction the savvy sales organization pursues a revealing question chain:

- What ultimate economic, regulatory or demographic market factors will drive such high demand for your customer’s product?

- Is this product introducing a whole new revolutionary value concept that no one has offered before (like the first microwave oven) or is it an evolutionary product (like current microwave oven offerings) – just bouncing along an incremental improvement curve?

Purchasing managers almost always over-predict the anticipated adoption of their new products. However, the answers to the two questions above may reveal a truly large and compelling market opportunity. For example, a firm that makes metal fabricated parts for military and aerospace customers may find in its pipeline an opportunity for a part for a medical device. That opportunity may represent a number of situations: a) someone looking for a competitive quote to replace their current supplier, b) the need for a part for an evolutionary incremental product or c) a breakthrough new product. Looking at the face value of the opportunity may not reveal the truth behind the opportunity. Only by delving deeper can the truth of new market opportunities be discerned.

International:

The demographics and economics of India and China are intriguing. The average age of the population is much lower than in the United States, their educational levels are growing, their income per capita is growing and their middle class is also growing. Indra Nooyi, the current CEO of PepsiCo, when asked where her company will be investing in the near future stated those facts – along with two population statistics that clinched the answer. India has a population of 1.1 Billion people and China a population of 1.5 Billion people. (Current stats are 1.2 Billion and 1.3 Billion people respectively). For PepsiCo the investment decision is made.

Those investments will require infrastructure and support – a “demand-halo” – from smaller companies, creating an opportunity for international expansion. Navigating the local laws, regulations, cash repatriation and other idiosyncrasies of international expansion is a bit of a challenge but it can be done. If you don’t do it, someone else will – likely some competitor.

Conclusion:

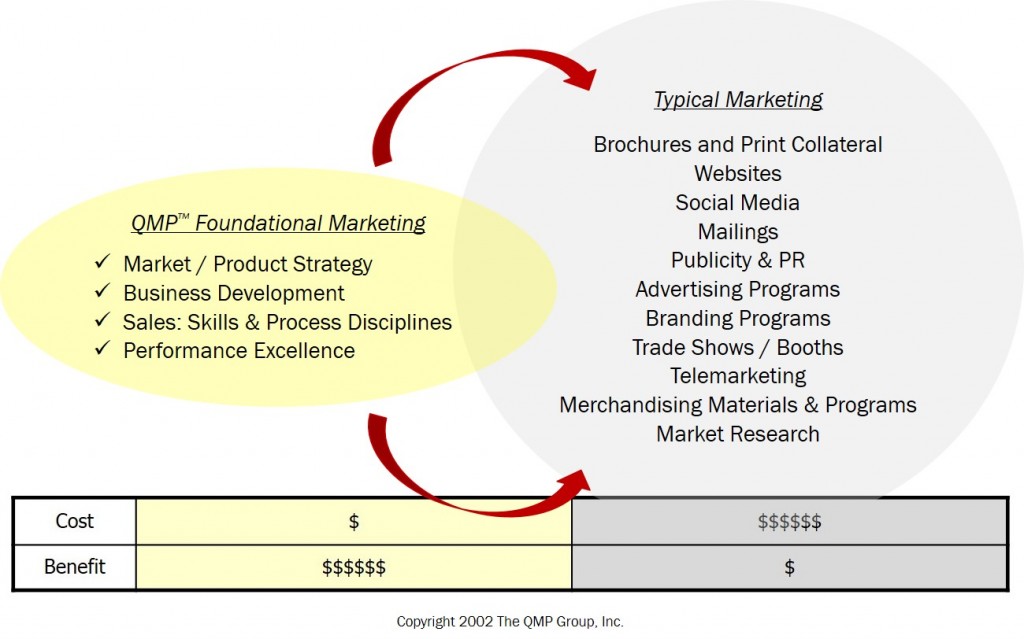

Given the incredible amounts of money spent today on branding, websites, Search Engine Optimization, sales promotions and tradeshows it is sad that a small portion of those funds do not find their way to support a “market opportunity sleuth” (MOS). Even if your firm has only 10 people in it – assigning the job of MOS to even one-half a person would be wise. That person should be responsible for scouring the areas listed above and reporting monthly on findings. After all, even if only one breakthrough opportunity is discovered in the course of a year – the investment would be worth it.

Read our related posts “Diagnosing Stalled Sales” and “Foundational Marketing – and please send us your comments.

For more information about Finding New Markets and Assessing their Viability call QMP at 503.318.2696 or eMail Jerry Vieira at jgv@qmpassociates.com

Copyright Jerry Vieira and the QMP Group, Inc., 2012

******