“Not every customer receives the same level of value from your product or service. It makes sense that those who receive the greatest value are more likely to buy it, pay more for it, be happier with it, tell others like themselves about it and return when they need more. So, if you’re launching a new product, why not start there?”

I love this photo. It precisely captures the reaction of many clients struggling with stalled sales when they first hear the suggestion that a narrower market focus might be the best way to overcome their problem.

Their faces, and sometime their mouths, say, “Are you nuts!? We don’t have enough business now, and you want us to NARROW our efforts? We should be EXPANDING, not focusing.”

The truth is, many times broadening a company’s marketing and sales efforts is not the best cure for a stalled-sales situation.

Focus is.

The “Everybody Can Use It” Fallacy: The Emotional Fuel Driving the Desire to Expand vs. Focus

Quite often when I ask clients who their product is targeted to, they reply with a vague, “Well, just about everyone can use it”. The false corollary is then, “So, we ought to make everyone aware of it and try to sell it to anyone and everyone. Right?”

No, not really.

Why?

Because not everyone receives the same level of value from your product – and it makes sense that those who receive the greatest value are more likely to buy it, pay more for it, be happier with it, tell others like them about it and return when they need more.

So, while there may be some truth in the statement “Everyone can use it”, it doesn’t mean that you will be successful selling to everyone. You will be most successful, and get the greatest lift, from those segments in which the value proposition has the highest significance.

So why not focus on those high-value-received markets first, reduce your wasted energy and money and increase your success rate?

How do you focus like that? And what’s the risk?

First, pick the best market to focus on.

That market must have the following attractiveness characteristics for it to be worthy of your focus:

- economic momentum,

- a common problem that you can fix with your offering,

- lots of people with that or a similar problem that haven’t solved it yet,

- a strong economic (or other) benefit that accrues to the customer from fixing that problem,

- a lot of peer customers they can tell about it, and

- a well-developed peer-to-peer communications network

For new or innovative products, it is important to have a real customer to which you have already delivered that incredible value – a verifiable case study, testimonial and reference account.

Sometimes it only takes one or two.

I was once asked to help a Product Manager that had refused to focus and whose product’s sales were so bad it was about to be shut down. She spent all of her time increasing distributors across the country – because, “everyone could use it”.

With just a little customer analysis we found just two current customers within one market, that had, unbeknownst to the manager, received enormous benefit from the product – and with just a few phone calls and visits confirmed that the market they represented had all the characteristics of attractiveness discussed above.

We refocused efforts by tailoring the story for that market, reduced spending, increased sales focus and greatly increased penetration as a result. The largest single order from that market prior to focus was $20,000. After focus, within a year, the largest single order was over a million $. In addition, the number of large customers in that segment purchasing product went from just the original 2 to over 150. Finally, the average selling prices increased by anywhere from 2 to 4X, as customers in that market requested further market-specific product features.

This is only one of a number of similar situations in our archives.

Won’t We Miss a Lot by Focusing?

Focus just means your primary effort, targeting, messaging and resource allocations are aimed and tailored to your highest-value-received segment of the market. It does not mean you ignore other customers that unexpectedly come knocking. It just means that your primary attention is elsewhere.

So, service well the customers from outside your primary focus that unexpectedly arrive at your doorstep. Just don’t get too distracted by them. But, quickly analyze why they bought. A few may well represent yet another high-value-received segment to approach after you have developed a strong and comfortably defensible foothold in the first.

You must constantly be on the lookout for what Peter Drucker has called “The Unexpected Success”. An unexpected success is a customer buying your product from some crazy, unexpected market that seems, well, weird.

No, I am not talking about Portland, rather from a market segment that you can’t imagine why in the world they bought. As weird as it may appear at first, it could be an early indicator of high value received.

Constant vigilance will assure you don’t miss something big by focusing.

*****

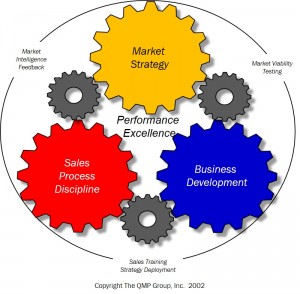

Jerry Vieira, CMC is a Certified Management Consultant and President & Founder of the QMP Group. QMP is a Portland-based management consulting firm specializing in market strategy, marketing & sales organizational transformations and training & coaching. Read more about Jerry on LinkedIn and follow on Twitter at @JerryatQMP