Too often, acquisitions don’t deliver the results expected

You are probably as perplexed as I am, at the repeated difficulty that acquisitions have in delivering on their promises of growth.

The title of a June 2006 survey report from Accenture says it clearly, “Executives Report that Mergers and Acquisitions Fail to Create Adequate Value”. The subtitle was, “Deals Often Come Up Short on Delivering Anticipated Revenues, Expected Cost Savings and Successful Integration of Information Technology”, caps the point.

When asking acquirers what causes these shortcomings, there are usually a handful of common responses.

• “The integration is not going smoothly.”

• “Their market took an unexpected dip”

• “Their new product isn’t coming out as fast as we’d like”

Few will admit that the culprit may have really been an inadequate due diligence process – one that failed to reveal some fundamental weaknesses in the market position or capabilities of the target company.

The “Dead Man in a Canoe” Model of Acquisition Due Diligence

The canoe model begins with the premise that even a dead man in a canoe will make great progress downstream, if the current is flowing fast enough. In fact, a dead man in a canoe will make even more progress than a live man rowing backwards. But, if the water level in the stream is so low that the bottom of the canoe is hitting the stream bed, no one – a good rower, a dead man or a backwards rower – will make any progress at all, no matter how much someone paid for the canoe.

Five factors can be used to asses the reality of the growth potential and the marketing and sales capabilities of an acquisition target.

• How does the acquisition select their target markets and where to invest their development resources? (How did they select the streams to put their canoes in?)

• What is the fundamental health and momentum of the primary markets they participate in and depend on? (How fast are the streams flowing that they currently have canoes in?)

• How valid are both their claimed value proposition and competitive advantage? (How good are their canoes?)

• How healthy (really) is their sales pipeline? (How fast are they moving downstream?)

• How talented and capable are their people? (How strong are their rowers?)

Few investment analyses dig deeply enough to understand these factors. Yet, they ultimately portend long-term success or failure.

The Five Under-Acknowledged Assessment Factors

1. What process do they use for selecting their target markets and investments?

Most smaller acquisition targets simply don’t have their own good process for selecting markets to target. If the acquisition target is currently successful, it may have been through rapidity, responsiveness and informality in the organization that allowed quick adjustment when a market was not responding. Rapid trial and error eventually resulted in the discovery of a “savior” market before cash ran out.

If the acquisition target does use a good target market selection process, then it is probably being validated by their growth history. But, if their growth is temporarily stalled, take it as a red flag. Putting the acquisition’s markets through your own process for identifying lucrative target market opportunities provides a quick sanity check.

If the acquisition target doesn’t have a good process, then that upgrade is the first thing to do when, and if, the acquisition is completed. Leaving this upgrade incomplete after acquisition, assures future stumbles.

2. What are the health and momentum of the primary target markets the acquisition participates in and depends on?

Market demand and momentum are driven by a combination of three fundamental factors; demographics, economics and regulation. There isn’t much anyone can do about the first. However sometimes simply shifting market focus from one segment of the market to another catches a subcurrent of demographics that accelerates demand.

For example, the number of hospitals in the U.S. is declining. The Philips defibrillator business can keep trying to sell into emergency rooms in a saturated hospital market or move to the consumer/commercial market fueled by the demographic of aging baby boomers and government mandated emergency preparedness initiatives.

The economics factor is more complex than demographics. There are macro trends, micro (market specific) trends and, what I’ll coin as, nano-economics (the economics associated with the individual customer sales transaction). If all three are flowing in the right direction, the results are positive. However, streams usually slow down top to bottom. First, macro economics fail, then micro, then nano. For the experienced executive, finding and evaluating the macro and micro level momentum factors should be relatively easy.

Too many acquisitions are bought for product reasons (complementary offerings, new technology, brand name et al) vis-à-vis solid market momentum reasons. Market momentum covers up a lot of inadequacies, at least at the beginning. Its better and easier to have market momentum on your side when the inevitable challenges of acquisition integration arise than not.

3. How valid are both the acquisition’s value proposition and their competitive advantage?

Here’s a sad, but not surprising, story. At a mini-workshop for a group of a dozen CEOs and owners of small-to-mid-sized B2B businesses, they were given a simple challenge. They were asked to imagine their ideal target customer prospect and match it to their best product or service offering. Then they were asked to calculate the typical five year economic benefit that the ideal customer would receive from that offering.

Not one person in the room could do it in the 15 or so minutes available!

In an article by this author published in the December 2007 IndUS Business Journal entitled, “The Seven Laws of Performance Excellence”, the first is the Law of Economic Value. It states, “The source of all economic value in any business is a customer’s belief that they will receive favorable economic, emotional or physical value in return for the cash they are willing to spend with your company”.

There must be a customer-perceived imbalance in the economic, emotional or physical value equation, in favor of the customer. It is what drives nano-economic momentum. This is the true nature and reality of the acquisition target’s value proposition. It drives new product adoption. How well it is delivered vis-à-vis competitors is the true measure of competitive advantage.

A number of years ago, I was asked by a capital equipment companyto review their acquisition rationale for a target firm. I asked, “Can you state how the acquisition of this firm will ultimately provide increased economic value to either your, or your acquisition target’s, customer base?”

Stunned silence answered the question.

If an acquiring company cannot somehow tie its target acquisition investment to the Law of Economic Value, the natural selection forces of the marketplace will ultimately depreciate the value of that investment. Value to a customer ultimately rules.

4. How healthy is the sales pipeline?

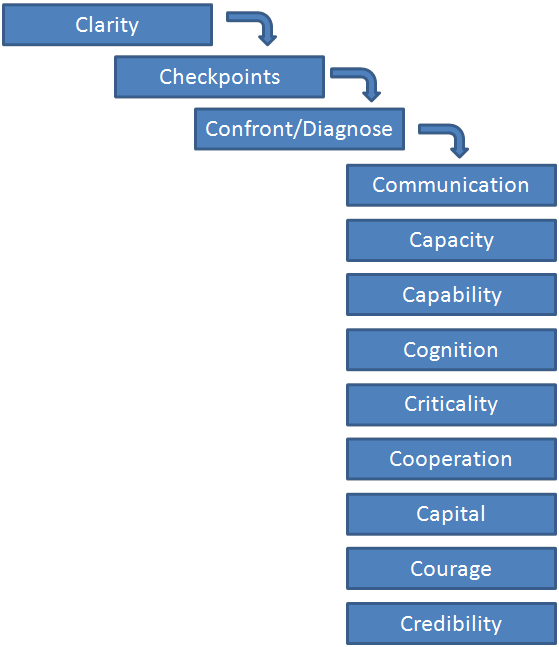

Does the acquisition target have, and use, a good disciplined sales process?

Sales opportunity pipelines (or, as some call them, sales funnels) are common support documents in the due diligence process. Rarely does an acquiring firm have a good process for assessing its validity.

Here are six suggested criteria for assessing each major opportunity in the pipeline:

1. Compelling Need: To what degree does the customer have a critical need to solve the problem that the company’s product addresses? Is this awareness from the customer’s perception or our own? Can that potential customer do nothing? Sales research shows that between 30 to 50% of all pipeline opportunities are lost to “nodecision”.

2. Match: How closely do our capabilities match that customer’s need?

3. Economic Equation: How strong, from the customer’s perspective, is the economic value proposition for fixing this problem? Has this value been demonstrated to, and believed by, the key customer decision makers at this account?

4. Competitive Position: How do the firm’s competitive capabilities compare, from the customer’s key decision-makers’ perspectives, with other possible solutions?

5. Champion: How strong is the internal champion at the customer account? How politically powerful, influential, receptive is the champion in the decision process?

6. Leverage: In addition to a sale, what else is gained if the account is won? Does the opportunity open up a new market or help develop a new capability? Does it provide a referral and great testimonial?

It may seem that this kind of effort for each of the target customer’s sales people and each major opportunity in the pipeline is a lot of work. Well, it is called due “diligence”, isn’t it.

The truth is that, if you use a pipeline validation process like this, pipeline “fluff” falls away quickly and the real value of the sales opportunity pipeline is revealed.

The second factor to be considered in sales function assessment is whether the acquisition target has, and utilizes, a good sales process.

A good sales process is recognizable by its ability to not only win a high percentage of opportunities in the pipeline, but also do the following:

• Produce frequently updated, easily visible pipelines

• Create accurate bookings forecasts

• Help formulate sound account opportunity strategies and action plans

• Collect, communicate and process account, competitive and other market intelligence • Sell economic value, and

• Optimize a sales person’s time

5. How talented and capable are the marketing and sales people?

When embarking on an acquisition and beginning to meet the people at the acquisition target, those employees can usually be sorted into three types.

The first are the “fearful-skeptics”. These people are simply trying to keep their jobs, stay under the radar and do whatever it is they need to survive the acquisition integration.

The second type are the “hostiles”. They fear loss of power or influence, the coming discomfort associated with an upset of the status-quo, exposure of their incompetence and/or visibility given to their lack of progress.

The final types are the “eager-embracers”. They are the ones that usually say something like, “I’m looking forward to this. I can really see the benefits. I’ve been formulating some innovative ideas for some time, that I’d like to share with you. How can I help?”

These last are the few who will already have developed their own process, who continually want to see things improve and who simply can’t stand ineffectiveness, slowness and inefficiency. Just a few of this type is critical to have in a good marketing and sales organization.

In assessing the people and talent there should be two key roles represented.

One Good Marketing Strategist: One good, talented marketing strategist can create programs that launch firms into incredibly rapid growth opportunities.

A Few Good (Sales) Men: In sales there should be a few very good and influential sales people that can act as internal opinion leaders. In this role they provide support for the transition with peers and customers, and, through their example, help other sales people learn how to manage the acquisition integration and its incumbent changes.

Conclusion:

There are many reasons for acquisition.

Venture Capital and private investment firms look to discover and increase value for extraction at some future pointand commercial businesses typically look to acquisitions to accelerate growth, capture IP, open up new channels or gain rapid entrance into a new market.

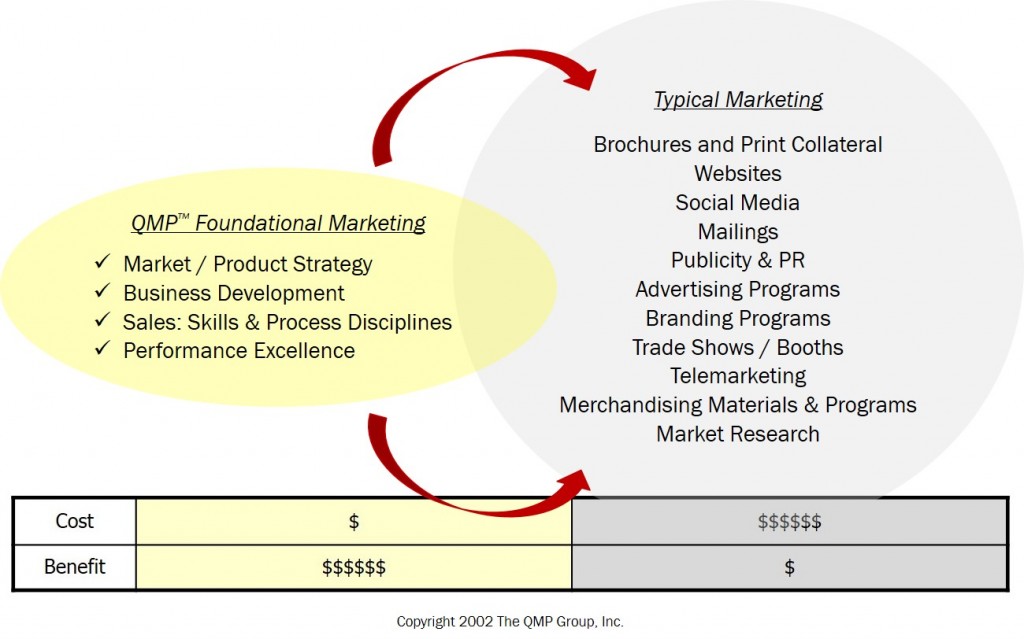

Independent of the type of acquiring firm or the ultimate purpose of the acquisition, those embarking upon the due diligence process are encouraged to adhere two basic principles:

• Be cautious not to violate the Law of Economic Value — the negative consequences of violation may not be immediate, but they are inevitable, and

• Put more “diligence” into the due diligence process when it comes to the evaluation of the marketing and sales functions of the acquisition target.

One final point: Should the good revelations outweigh the bad in this 5-factor analysis and the deal close anyway, by virtue of having dug deep enough to discover the acquisition target’s weaknesses, the acquiring firm has already laid out before them the roadmap for improvement.

******

To learn more about the QMP approach to due diligence click here.