The word audit can strike fear into the heart of almost any person or organization that is its target. “Audit” conjures up images of someone in a position of authority digging through paperwork and records looking for evidence of malfeasance, mistakes, incompetence or non-compliance.

However, when a business performs an audit on their marketing and sales function, they typically just want to answer two basic questions:

- What can we do to improve our sales results?

- What can we do to improve our marketing and sales ROI?

At its purest intent a marketing and sales functional audit should not conducted to uncover incompetence, to fix blame or to penalize, but rather to discover opportunities to make both marketing and sales more effective. If the motivation of an audit is solely to find a scapegoat or assign blame, the problem is not in the firm’s marketing and sales function, but rather in its culture and leadership.

Step 1: A Quick Starting Point – The Self-Audit

We, at QMP use an 8 dimension, quick 50-question self-audit or self-assessment approach to determine whether there is need for deeper investigation. The output is a simple spider graph which illustrates the impressions that the executive team has of its marketing and sales organizational capabilities and effectiveness.

Figure 1

Copyright The QMP Group, Inc. 2012 All Rights Reserved

The shape of this figure provides a general idea of where performance gaps are perceived to exist. However, this is a chart which reflects executive impressions and personal observations – not a formal, detailed analysis of processes and capabilities. If the chart reveals high capabilities, but sales performance is actually poor, there is strong misperception among the executive team. But if both the chart output and the firm’s performance are satisfactory, the need for a detailed audit is probably not compelling.

(Click here to request this free self-assessment tool)

Step 2: The Detailed Audit:

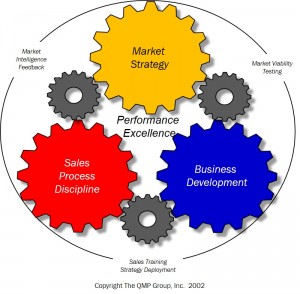

If a detailed audit is indicated, the model in Figure 2 provides a framework for conducting that audit. Each of the 8 dimensions of the spider graph will be evaluated within that model.

Figure 2

he Marketing & Sales Engine™

Copyright The QMP Group, Inc 2002 All Rights Reserved

Copyright The QMP Group, Inc 2002 All Rights Reserved

All gears must turn efficiently and together for optimum revenue generation. If any gear is broken or stuck, the engine stalls – and it can only turn as fast as its slowest gear. If a marketing and sales audit is going to identify opportunities for breakthrough or discover where things are malfunctioning, an audit must assess the systemic working of all the gears – even the little ones. One must even include in the audit the oil in the oil pan – which we call Performance Excellence, or the Culture of the firm. A healthy corporate culture can grease, or an unhealthy corporate culture grind to a halt, the firm’s marketing and sales engine.

Auditing the Gold Gear: Market Strategy:

“Even the best soldier becomes a casualty when engaged in unwise battle strategy.”

Audits of Market Strategy often lead to the greatest sales breakthroughs. It is common that a strategy audit reveals a lack of market focus. And though it may seem counter-intuitive to consider narrowing rather than expanding one’s market range, a redeployment of resources to a more tightly-defined, more economically lucrative market segment, almost always results in accelerated growth and less cost.

In one case, prior to a strategy analysis, a rather smug marketing and sales executive said, boasting “I don’t care who buys them (his products) or for what reason. All I care is that they buy a lot.” His attitude reflected itself in the highly unfocused efforts of his sales team. This manager did not expect significant impact, nor did he believe much would be revealed, from a strategy audit. In actuality, the audit triggered a strategic market re-focus which triggered strong double-digit growth for a handful of years while enabling price premiums along the way.

Opportunities for sales breakthroughs are available by looking into other aspects of the firm’s strategy as well, not just its strategic focus. Breakthroughs can be found in analysis of the channel-to-market, pricing policy and the alignment (or rather misalignment) of all the components of the strategy together.

Auditing the Blue Gear: New Business Development

The Business Development gear comprises what most people consider to be classic, tactical marketing. It includes the firm’s e-commerce process, web presence, advertising, sales tool kit, lead generation process, print collateral, trade shows, branding, press relations, publicity and social media. Contrary to the intuition of many – more emphasis on this gear is not always better. Conflicts arise when the strategic intent is to focus while the tactical marketing team is hell bent on “getting our name out there” to as many people as possible.

A Business Development audit can reveal such things as: a) misaligned messages and focus, b) opportunities for shifting resources from expensive promotional efforts (trade shows, advertising) to more effective and less expensive targeted publicity and press relations, or c) a poorly conceived sales tool kit.

One of the most common gaps in a firm’s Business Development program is the lack of a “Thought Leadership” program. In general, thought leadership is the process of building a highly visible industry presence and reputation for your firm and your people, as industry experts. When people look for a solution, they often seek out the experts first – most of the time these days, with an internet search. Thought Leadership is typically the role of technical specialists, marketing spokespeople or senior executives of your firm – the people with enough technical or industry knowledge to be considered experts. “Thought Leadership” involves public speaking, writing and publishing articles, writing blogs, participating in industry association panels, conferences and committees and even involvement in community issues. That activity is heavily reflected in internet presence.

Auditing the Red Gear: Sales Process Disciplines

Within the sales function, the audit checklist is long. Here’s a sampling:

- the reality, quality and current value of the sales pipeline

- the usefulness of the sales tool kit

- the relevance, effectiveness and currency of the sales training program

- overall sales process effectiveness

- the discipline of providing, and quality of, market intelligence feedback

- the sales person’s understanding of the value proposition, differentiation and ideal customer profile, particularly for new products

- the alignment of the compensation plan to the strategy

Something as simple as re-establishing focus on the Ideal Customer Profile can achieve rapid and significant results. While running a mini-audit, one of our clients discovered their sales people did not have a clear idea of the types of opportunities they should be pursuing. Sales sent in everything they dug up for a bid, swamping the quote department.

We took the client through a focus exercise and profiled the ideal opportunity. It took only a couple of hours to formulate. Within 9 months of this re-focus, their win rate had increased by more than 15% while the number of quotes generated decreased by nearly 33%. They won more of the right kinds of profitable opportunities. It was that simple. Less waste. More success. No blame.

Low-to-no-cost adjustments to issues discovered in an audit are common and can significantly increase sales productivity.

For example, research has shown that 35% to 50% of the customer opportunities in a sales person’s pipeline will never reach a “buy” decision. These are costly, unproductive investments of sales and support resource that have ended up in the “No Decision” bucket.

The likelihood of an opportunity ending in a “No-Decision” is inversely proportional to the degree of the “Compelling Need” a customer feels about solving their business problem. If a customer is not faced with a compelling need to fix their problem they will not buy any solution – yours or your competitor’s. A quick audit of the sales opportunities in the “No Decision” bucket brings cold reality to bear on the need to do a better job of qualifying customers.

Auditing the Soil: Performance Excellence, aka the Culture:

Think of a company’s culture as its soil. At its best, it is nutrient rich and encourages growth. Think of strategy as the seed. Even a genetically perfect seed will not grow in nutrient starved soil. On the other hand, a genetically inferior seed, planted in nutrient rich soil, will at least yield some crop. Culture is everything.

The nutrients in a firm’s culture are its values and its behavioral norms. In our experience, the best cultures exhibit the following characteristics:

- the setting of clear expectations

- individual and organization accountability

- clarity of ownership of initiatives and results

- measurements and metrics

- rewards and consequences tied to performance

- honesty and openness in communications

- periodic progress checkpoints (at minimum, monthly)

- a sense of urgency to deal with barriers and challenges to progress

- teamwork

- a creative problem-solving orientation focused on solutions not blame

In our engine model the culture is the oil in the oil plan pan in which the gears move. The culture lubricates and sustains a healthy engine. Without oil the engine seizes up. Without a solid culture of performance excellence, your business seizes up.

Conclusion:

A marketing and sales audit is simply a periodic analysis of what’s working and what’s not. It is a discipline that requires digging into the marketing and sales process to look for opportunities, barriers, bottlenecks and trends. We know from experience, that initiating an audit and analysis, with the discovery of root cause as its objective can spark sales breakthroughs and improve marketing & sales ROI.

A Final Note: A Marketing & Sales Organizational Self-Assessment is not the same as a Marketing & Sales Audit

A Self-Assessment is an organized compilation and scoring of your perceptions about the capabilities of your marketing and sales organization and processes. An Audit is a validation or invalidation of those perceptions from a deep dive into weaknesses and root causes of performance gaps. Self-Assessments record perceptions. Audits discover reality.

*********

Copyright 2010 The QMP Group, Inc. All Rights Reserved

Learn more about what kinds of growth opportunities a QMP Marketing and Sales Effectiveness Audit can reveal. Or, request a free QMP Marketing and Sales Organizational Capabilities Self-Assessment through our Contact Us Page. We’re here to help.