There are two statements I hear repeatedly when speaking with professional services firms. The first is, “It’s a relationship business.” The second is, “We generate the majority of our new business through networking and referrals.”

In fact, service professionals (attorneys, bankers, financial advisors, IT service providers, consultants, brokers and accountants), tell me that they are encouraged (if not by their bosses, by everything they read) to attend a lot of networking events, engage in conversation, not drink too much and hand out business cards.

They are, in effect, being encouraged to play a numbers game. The more events attended and the more cards handed out, the more new clients. Why this approach? Because, it has worked in the past – and if it is not done, new client opportunities dry up. With all the hype in recent years about branding, eMarketing and social media – networking still ranks as a top priority for generating new clients for professional services firms.

But, think about this kind of networking for a moment. In the 30 minutes or so before an event speaker is introduced on the dais, you are supposed to: a) meet as many new people as possible, b) demonstrate sincere interest in who they are and what they do, c) identify their key challenges, d) empathize and e) build up enough mutual trust to get them to remember you well enough to agree to an appointment in the the next, oh let’s say, 3 months. There must be a better way.

The professional services marketplace is much more competitive these days. A lot more people are handing out a lot more business cards at a lot more events. In addition, a swarm of unemployed executives, and there are many, are buzzing the networking circuit. The bottom line is that professional services firms need a better way than traditional networking to stand out and find new opportunities in this market. They need a more effective way than traditional networking to generate the essential credibility and trust that precedes all new client opportunities.

Front of the Room Networking

Front of the room networking is the act of being the headline speaker at networking and other business events. It has incredible power to attract new prospects and many advantages over crowd surfing. The following list of advatntages illustrates the power of this approach:

1. An intriguing title will attract the right kinds of prospects with the right kinds of problems

Picking a title which addresses and offers approaches to problems commonly faced by your clients is a way to garner interest in your talk. In fact, if done well, the people attending will self-pre-qualify simply by demonstrating enough interest in the topic to attend and listen.

I recently offered a topic to an organization of management accountants for their October monthly meeting entitled, “How to Judge the Reality of your Marketing and Sales Team’s 2012 Forecast”. October, being coincident with most firms’ annual planning efforts, was perfect timing, and the topic being relevant attracted a good amount of attention.

2. Offer to speak at a venue that attracts, by function and title, the key decision makers or influencers for the service you provide

While it may be flattering to be asked to address the local Boy Scout troop, and you may get a feeling of civic and professional pride in doing so, if your professional services are bought or recommended by B2B CFOs, you may want to reserve some energy and your best jokes for the latter crowd.

3. Insight is Essential

Assuming you are addressing the right crowd, with the right topic, with an intriguing catchy title, your talk must provide insight. To be effective it must have the effect of causing people to tilt their head, look up toward the ceiling and say to themselves, “I never thought of it that way.”

or

“ Wow! That’s a clever approach.”

or

“Wish I had thinkers like that in my organization.”

or, best of all …

“I MUST to talk to this guy/gal after he/she finishes.”

4. The hosting / sponsoring organization typically does all the logistics work

They invite the people, promote the event, reserve the venue, arrange and pay for the breakfast, lunch, snacks, coffee, beer or wine (depending on the time of day), provide you a flattering introduction and assure that the place is cleaned up afterwards.

5. You speak (and consequently network) to the whole room at once

Being the featured speaker at a monthly meeting typically permits you to address 25 to 100 people simultaneously, instead of engaging in chit-chat one-on-one for 10 minutes with each of 3 people. As mentioned above, typically networking and association get-togethers allow 30 minutes for that kind of chatting before the speaker starts. That allows time for meeting 3 new people – if you don’t waste time catching up with your buddies first and talking sports, books or politics

6. You have their uninterrupted attention for 45 minutes

For this networking approach to work, you must be an engaging speaker and deliver value. You cannot take advantage of the opportunity and try to sell. You must be willing to share.

Many people feel they will be giving too much away if they do this. As a consultant, my experience is that you can give someone your complete process binder and they will not be able to deploy it without your help. The caution is that you can really only share so much. You must protect your Intellectual Property – but do not fear to share a lot. It builds your credibility, demonstrates your expertise, illustrates your commitment to help and provides more opportunity for your listeners to want to talk with you afterwards.

7. It helps you continue the development of your ideas, products and intellectual property

The compelling need to think and develop your talk after you have committed to it, has the added benefit of forcing you to take thinking time. This thinking time always generates new ideas that you can test with the new audience.

And here are some tips for giving a great talk and getting great results:

1. Assure you have an audience of decision makers or highly placed (by title) recommenders

As a colleague of mine said, “Pick your talks by who you want to listen to you, not by who accepted your talk”. Before i recognized this, I wasted more than one evening giving great talks to very interested attendees who weren;t anywhere near the decision to decide on using my services

2. Make your presentations interactive

Another key point is the need to engage interactively with your audience versus lecturing. Small exercises that illustrate key concepts are very helpful. One of the most effective tools is some sort of self-assessment which illustrates key gaps in the current situation of the attendees.

3. Make frequent eye contact with individual people in the room.

It gives listeners a feeling of a personal conversation and intimacy with you even though there may be 100 people in the room.

5. Don’t forget to smile

If people see you are enjoying yourself, and excited about talking with them, they will enjoy themselves and be excited about talking with you.

6. Exchange business cards after your talk

If the sponsoring organization does not provide for it, offer to make (and personally deliver) copies of your presentation to the attendees if they provide you a business card. Also ask if they would mind being on your mailing list when you get their card. At the accountant meeting mentioned in Point 1 above, out of 50+ attendees, I collected 12 business cards after the talk by people coming up to me, expressing their appreciation for what I had to say and requesting the presentation. Within the next few days, I had scheduled four appointments.

7. Follow up quickly, when they ask you to

A final point is worth repeating: Remember, you are never selling when you give one of these talks. You are providing information and insight. The sense the audience feels of you as an expert is what creates the magnetic attraction for you to come and solve their problems.

Summary:

Speaking in front of crowds is an integral part of Thought Leadership and an active Thought Leadership effort is essential for a professional service providers’ business development efforts. A well constructed Thought Leadership effort builds brand, reinforces your individual and firm’s reputation as experts, piques client interest, builds web traffic and provides opportunity for price premiums.

For a good book on the pillars of Thought Leadership, grab a copy of “The Expert’s Edge” by Ken Lizotte (McGraw Hill)

*******

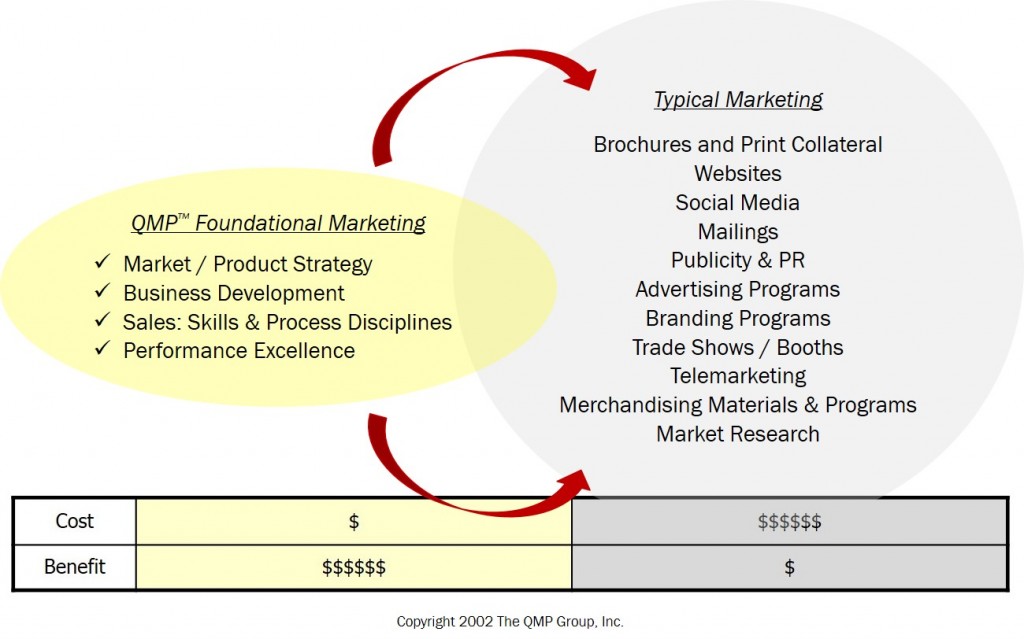

Networking from the front of the room and other Sales and Consulting business development practices are part both the QMP Sales Skills and Process Workshop and the QMP Consutlancy Navigator Program offered by The QMP Group. Click on their titles to learn more.