Just Ignoring or Pushing Through the Pain is Not the Answer

As an entrepreneurial CEO or owner of a small or start-up company, you probably don’t have the economic safety net to tolerate long term losses or less than adequate speed and growth in the adoption of your new products. You also may not feel you have the time or cash to stop everything, pull the team together, and completely re-visit your base assumptions and offering design. This is where panic sets in. What do you do?

Typically, if you ask your marketing, sales and engineering team what should be done, they will come to you with a laundry list of quick fixes: requests for price reductions, funding approval for new marketing initiatives or even more complex and higher performance product features which, they claim, are certain to turn around the problem. As CEO how do you know what to bet on? How do you know if you’re throwing good investment dollars after bad? How do you avoid having to seek out more funding and perhaps dilute ownership?

A number of years ago, I was asked to assess the viability of a new product that was struggling to gain traction in the marketplace. The CEO of this high-tech, pre-IPO firm wanted to know whether the product line could be saved. Sales were almost non-existent – profits negative. There was no breakthrough in sight.

The product manager of this line was convinced that if the psychological price barrier of $1,000 could be broken, customers would flock. The current selling price was $1,100. In the meantime, while price reductions were being considered (not seriously), the product manager was spending his time and budget setting up new distributors around the country, building promotional materials, stocking shelves with minimum quantities, training sales reps on how to demo the product and, in general, “flogging” (his word, not mine) and constantly “badgering” (my word) the distributors to produce more sales.

Two weeks of field investigation revealed a strategic opportunity to re-focus the market strategy. Twenty four months after that refocus:

– the selling price had increased from a $1,100 to more than $4,000. (Yes, it went up, not down!)

– the largest single customer order went from $20,000 to more than a $1,000,000

– the number of customers (hospitals) grew from 2 to more than 150

– the product-line, and the people, were saved

– the story added to the attractiveness of the IPO

And all this was accomplished while spending less in marketing, not more.

How was this accomplished?

This turnaround was made possible by discovering what, up to that time, was an ignored sector of the current customer base, where the product’s value proposition was significantly greater than for other customers. The business was then refocused on that smaller, yet more lucrative, group of customers. Focus allowed a reduced marketing budget. The result was greatly accelerated adoption, revenue growth and profitability.

Peter Drucker in his book, “Innovation and Entrepreneurship” calls this, leveraging “the unexpected success”. It’s accomplished by digging through the customer lists, examining the motivations of a customer that bought (that you didn’t expect to buy), and discovering that the value proposition they received was well beyond both what you imagined and/or what other customers receive. If you then discover that there are a lot more customers out there like that one, with the same problem to solve, you have a great place to begin your refocus efforts.

There are basically two phases to these kinds of turnarounds. The first is a high level diagnostic exercise and the second is a process for assessing and selecting a lucrative alternative target market.

Phase I: The Diagnostic Exercise:

In this phase we encourage a simple hierarchy of 5 diagnostic questions to start.

Question 1: Does The Target Market Have Momentum?

A dead man in a canoe will make forward progress if the stream is flowing fast – and a strong current makes up for a lot of inefficiencies in rowing, and can even compensate for inexperienced rowers rowing backward. Momentum covers a lot of sins. Inherent market momentum arises from fundamentals in the marketplace – demographics, economics or regulations.

Question 2: Is the Economic Value Proposition Valid?

In B2B, both new and mature products must provide meaningful and calculable economic value from the perspective of the customer. Customers buy for their reasons, not yours – and even though you may be convinced that your product’s value proposition is universally meaningful, it does not mean your customers see it the same way. And not all customers in all markets receive that value to the same degree. So it’s important to get your team to honestly validate the economic value proposition through visits to target market customers in specific and different market segments.

Question 3: Is the Competitive Position strong?

The fundamental value proposition may be provided equally by any number of competitive offerings or alternatives in the market place. Unless target market customers can easily see your competitive advantage and recognize it as meaningful to them – you will not be able to break through the competitive noise.

Question 4: How effective is the channel in Communicating both the Value Proposition and Competitive Differentiation to the target market?

If you want a quick way to assess this, simply ask any of the team (marketing, sales, or engineering or channel partners) to calculate the economic value proposition (benefit) of the product or service offering to a typical target customer. Ask them to do it on the spot… back of the envelope. I am continually amazed how major product development and marketing initiatives are embarked upon without the slightest consideration to this critical success factor.

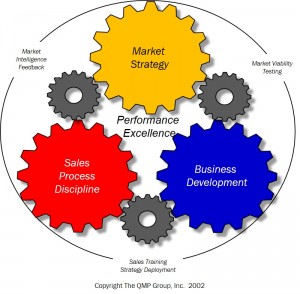

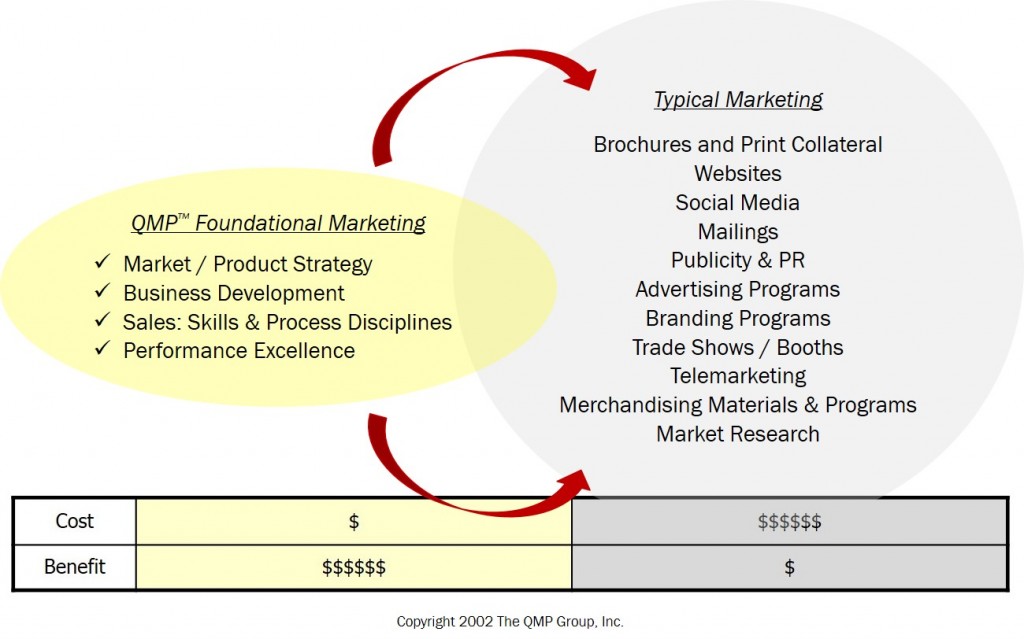

It is the natural instinct of marketing teams to spend a lot of money at this level and they typically believe that a magic combination of branding, promotion, websites, trade shows, collateral, promotions et al will somehow turn around a troubled product line. If there is any indication of a fundamental problem in the three primary diagnostic levels that come before this one – spending on level four will be fruitless.

We’ll take the canoe-and-stream metaphor one step further. A dead man in a canoe floating down a stream with strong momentum will actually make more progress than a live man in another canoe rowing backwards. So not only do you need a solid market to support a valid economic value proposition, and a competitive advantage to communicate, you have to have people trained in how to communicate it… and do it well.

Question 5: Can You Consistently Deliver the Value Proposition?

Production and quality problems may be the cause of stalled success, but we rarely find that we have to go this low in the diagnostic hierarchy before we find the real cause of a market adoption problem.

Phase II: Evaluating and Selecting a More Lucrative Target Market

In each of the major turnarounds we have experienced in the last 10 years, the real key was not so much the lack of a meaningful economic value proposition, but rather a lack of focus on the segments of the market that would receive the highest economic, emotional or physical value from using the product.

All economic value transfer to your company starts with a customer believing that there is sufficient reason (economic, emotional or physical) to write a check to buy your offering. Different market segments will perceive and receive different levels of benefit from the same product. Markets with the highest value received will yield the highest selling prices.

The 12 basic evaluation criteria for assessing and selecting the most lucrative markets to focus on:

1. Market Momentum: By this we mean the degree to which the market has fundamental demographic, economic or regulatory factors driving its primary demand. Here’s a caution: many firms and marketing teams get seduced by this factor alone – mesmerized by the lure of big numbers. Even large companies fall prey to this lure. But remember, the largest markets always attract the largest and highest number of competitors. Most of the time, it’s a better strategy to focus on a secondary market. It usually less competitive, less risky, less painful and penetration is quicker.

2. A Common Compelling and Significant Problem: It’s common that if one customer in a market segment has a problem, many others, to varying degrees, will be facing the same problem. If the economic benefit of solving that problem is significant, it’s likely that the willingness to pay a premium for solving it will be present.

3. Economic Benefit to the Customer: Calculate the economic benefit for a typical customer in each market segment. The likelihood is that you’ll get the highest selling prices in those segments where the economic benefit-received by the customer is the highest.

4. Financial Wherewithal of the Customer: Do potential customers in this market have the flexibility to buy and capture funding should the economic value proposition be significant? For example, the University market segment is typically characterized by hand-to-mouth funding availability and long research approval cycles.

5. Profitability of the Transaction: This factor assesses whether transactions in this market segment can be inherently profitable. Factors affecting profitability might be geographic, customization required and willingness to pay for economic value received.

6. Match of Company Assets and Capabilities: The annals of failure are replete with stories about companies who were seduced into attempting to penetrate large emerging markets for which their basic capabilities, assets, culture and structure were mismatched.

7. Accessibility: To what extent are the market, the channel and the key decisions makers readily accessible to your channel and sales process? You can’t communicate a value proposition to someone you can’t get to.

8. Lots of Unfilled or Under-Satisfied Sockets: A socket is a potential customer with the problem and the possibility of receiving economic benefit form solving it. Customers may have one or multiple “sockets”. In assessing market attractiveness we want lots of sockets – most of them still unfilled – or filled with a less-than-satisfactory solution.

9. A Well-Established, Vibrant Intra-Market Network: Studies of the diffusion of innovation reveal that the communication through the intra-market network is 13 times more significant in the adoption of an innovation than mass media.

10. Level of Competitive Turmoil: This factor gets rated opposite to the others. If there is a lot of competitive turmoil, rate this low. If not much, rate it high.

11. Experience and Reputation Match: If the market you are assessing already knows who you are, and your value proposition is consistent with whom you are, your brand name and your differentiators – then you can give this segment a high rating. This is the factor that many marketing people believe that “Branding Programs” can fix. But even the best branding program can’t make up for a poor economic value proposition or poor market momentum – and branding programs are typically very expensive

12: The Availability of a Relative Perceived Quality Leadership (RPQL) Position:Research from the Strategic Planning Institute, concludes that the single most significant factor affecting a business unit’s performance is the quality of its offerings relative to its competitors. The degree to which an RPQL-position available, unclaimed, or vulnerable (if someone already owns it), is a key factor in the selection of a segment on which to refocus.

Conclusions and Recommendations:

If you happen to find yourself in a situation of a stalled product line or business – our experience tells us that the last thing you need to do is spend more on marketing. In general, a business refocus is a much quicker and less expensive road to success.

A quick assessment of the customers that have already bought usually reveals those for whom the value proposition is significantly higher. Assessing the attractiveness of the market segment that they represent can reveal your opportunity to break out to success.

******

Learn more about strategically improving low sales performance here, call us at 503.318.2696, email to qmp1@qmpassociates.com or connect through our Contact Us page