“You can’t build a durable building on a weak foundation.”

We’d like to share an insight that has helped executives and business owners sort through all the hype and claims over the last several years about an ever growing list of “gotta-do” new marketing and sales techniques.

If you’re a General Manager, business owner or C-level executive, your marketing team probably approaches you annually with a laundry list of funding requests to support their critical marketing and sales programs for the coming year. Those requests may include any or all of; a website upgrade, a branding program, a social media expansion program, a blog, a publicity and PR program or maybe even a new six-figure trade show booth – not to mention the additional staff to help manage it all. How do you decide what to approve? How do you sort through all the hype and enthusiasm about each program and decide what will truly give you the best return for your investment?

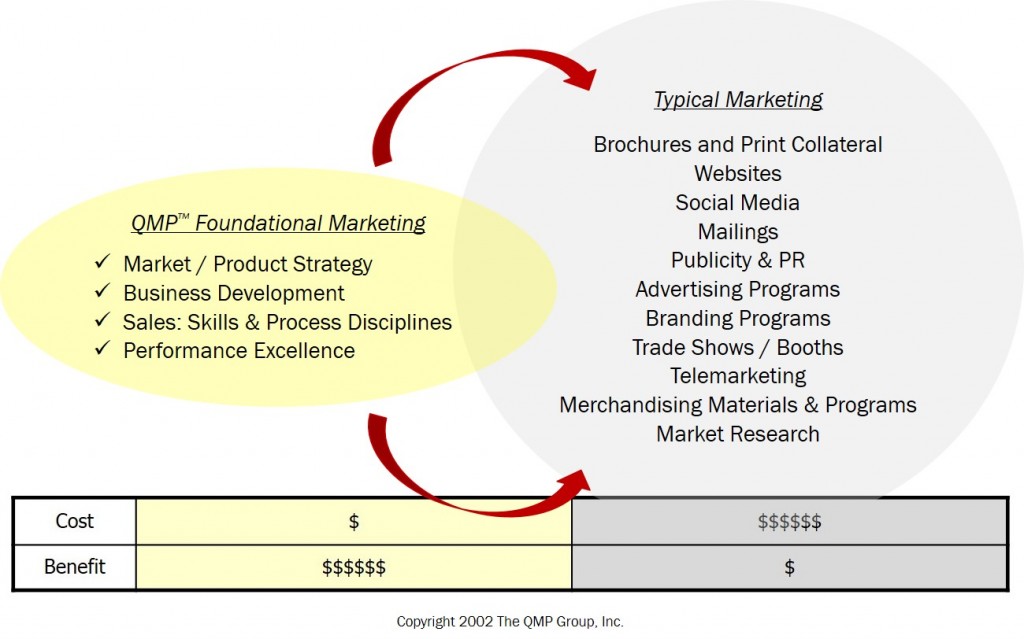

The graphic below illustrates an alternative approach to selecting marketing initiatives.

Most people think of marketing as one or more of the items listed on the right side of the graphic — in the grey, typical-marketing circle. Stop a moment and consider the list. Is this what you think of when you think of marketing? If yes, join the majority club. If not, join the other group. It has fewer members – but they are the ones who have found the secret to getting greater return on their marketing buck.

Most people think of marketing as one or more of the items listed on the right side of the graphic — in the grey, typical-marketing circle. Stop a moment and consider the list. Is this what you think of when you think of marketing? If yes, join the majority club. If not, join the other group. It has fewer members – but they are the ones who have found the secret to getting greater return on their marketing buck.

Before those of you in the smaller, enlightened group get smug, remember “typical marketing” programs aren’t completely useless. Let’s be realistic. These days, unless you operate a lemonade stand that will only be open for two weeks in August, everyone needs a website. So let’s agree that, to some degree, typical-marketing expenditures are necessary – and in fact, required, once the foundational marketing base is laid.

But, back to the point – the hidden secret about marketing and what the people in the smaller group know that others may not is this; Rarely will any typical marketing initiatives produce truly breakthrough results — and they can tie up a lot of money! What really sets up top and bottom-line breakthroughs is Foundational Marketing. Foundational Marketing is the stuff in the oval on the left. Foundational Marketing is inexpensive and the primary, required ingredient in every major success.

For any typical marketing expenditure to be productive, Foundational Marketing must be done well. In our experience, foundational marketing tools and techniques have produced remarkable results. For example:

- A software firm earned 1,000 new clients in just a little more than two years

- A fledgling medical product landed 150 hospital placements in its first two years, with some orders exceeding $1M. Prior to using Foundational Marketing techniques, this product was in only two hospitals, with the largest single order only $20,000.

- An electronics firm achieved a 50%+ growth rate for six years straight

- A components firm increased their win rate by 15% while investing 33% less quoting time

- A wholesale distributor generated a 47% increase in regional sales in 1½ years

None of these breakthroughs required a significant investment in typical marketing.

To contrast the effectiveness of the two types of marketing even further, in one of those cases above, after the success had been achieved using Foundational Marketing techniques a new management team invested in a mid six-figure re-branding typical-marketing program that didn’t move the needle a bit – losing the discipline of Foundational Marketing along the way.

Why don’t more firms adhere to Foundational Marketing disciplines?

They don’t know what they are: B-school educators are fantastic at teaching principles and concepts, but in general, weak at delivering a practical approach to moving those principles and concepts into practice. I speak from experience as, at different times, both an MBA student and MBA-level university instructor. Concepts and principles education does not equate to skills, tools and process disciplines. Most B-school graduates do not come out newly-minted with a honed skill set and tool kit.

They haven’t developed a standard tool kit: You are more likely to find a dozen carpenters that use the same field-proven tools and processes for their trade, than a dozen top B-school graduates that use the same tool kit and process for strategy development. Coming to the job site, most marketing practitioners have to create their own tools and processes, convince the executive team to learn, trust and use them and support the execution discipline to see the resultant strategies through to success. Not to place all the blame on the practitioner, many firms simply haven’t developed a Foundational Marketing process and tool kit.

It’s tougher to do: Typical marketing programs are an easy way out – particularly if everyone in the industry is “doing something”. They can be delegated and the deliverables are easy to see: a new web site, a new logo, a bigger show booth.

They don’t have the discipline to do the Foundational work first: Unless the top-dog insists that Foundational Marketing receives first priority and is the right way to do marketing, it won’t get done. Foundational Marketing is a “think-before-doing” approach.

They think it takes too much time: Building a good foundation doesn’t take long if you have the right tools. We have witnessed strategic decisions made in a few days with execution and success in as little as 90 days.

They don’t believe in it because they’ve never seen it work: Using and trusting Foundational Marketing principles does take some faith and practice, but the track record is proven.

Under the Hood of Foundational Marketing:

Practicing Foundational Marketing is really not difficult if you have the right tools. Good and sound foundational marketing tools are based on empirical marketing science. Even non-marketing people can learn and succeed using them. In a way, a good Foundational Marketing tool is like a cell phone. You don’t need to be an electrical engineer with an understanding of electromagnetic field and communications theory to use a cell phone. All of that has been done for you and integrated into the cell phone. Good Foundational Marketing tools have already integrated sound empirical marketing science into them.

Success with Foundational Marketing does require – and this is the difficult part – transforming the way your organization thinks and the way your team executes marketing and sales. It really comes down to a battle of the mind – more than a battle of the wallet. When your organization understands Foundational Marketing – and begins to use its tools and techniques, both the probability of success and the return on investment of your marketing programs skyrocket.

A complete Foundational Marketing approach has four components:

· Market Strategy: A proven and steadfast way to decide what market segments to focus on and what differentiated position to carve out for your firm and each of its products.

· Business Development Initiatives: These are about how you will approach the segment(s) of the market you have decided to target. While components of tactical (typical marketing) are included, emphasis here is on specific customers to target, specific messages to communicate, the customer’s buying process, channel-to-market decisions and leveraging the intra-market customer-to-customer communication network in the target markets of choice.

· Sales Disciplines: There are two parts of the sales disciplines component of Foundational Marketing. Both require training and consistency. First, an effective, consistent sales process is a must – one which qualifies, discovers needs, proposes good solutions, and wins/sustains long-term clients. The second part is a differentiated sales story that is meaningful to customers – one which assures that your unique benefits story is told consistently through all channels to all target customers. It’s a story that emphasizes the economic, emotional and physical benefits in the right priority, for the right customers, in the right market. Sounds obvious, but many clients actually fail in these two fundamental requirements.

· A Performance Driven Culture: Think of the components of Foundational Marketing as the gears of an engine, the culture of a firm is the oil in the oil pan. (See the figure below). To consistently achieve your goals, the organization’s culture must encourage teams to communicate, execute, adjust, think, make decisions and lead in an honest way. A culture of performance excellence is defined by: accountability, clarity of expectations, measurements and metrics, ownership, open and honest communication, fact-oriented, sense of urgency, rewards and consequences, frequent checkpoints and the ability to quickly and constructively confront barriers and problems. With a culture of performance excellence lubricating Foundational Marketing, the engine hums. Without the oil of a culture of performance excellence, the gears seize.

Can Foundational Marketing fail?

Foundational Marketing programs do fail – for one of three reasons: First, if an organization does not have the discipline to execute and follow through, any program will fail. Foundational Marketing programs are no exception. Secondly, it is possible that some firms are too far gone to be saved by a Foundational Marketing program. However, in 20 years of consulting, we have witnessed only one firm in the second category. They required a complete change of their business model to survive. They did survive, but at a much lower revenue level.

Finally, we have witnessed firms that have relapsed. Relapse is characterized by success with Foundational Marketing, followed by a reversion back to sole dependence on those items in the typical marketing list. Relapse is very costly in money, time and lost opportunity. A relapse typically occurs when a new, uniformed marketing and sales or C-level executive enters the picture.

A Final Word:

A good example of the need for foundational discipline is in the weight loss arena. The basis of all weight loss programs is discipline: discipline to eat better, discipline to exercise more and discipline to adhere to a healthy lifestyle. The latest exercise machine does not obviate the need for discipline.

So it is with Foundational Marketing. Good tools and processes are needed – but organizational discipline fuels the best results. Foundational Marketing, supported by a culture of performance excellence has proven again and again to lower marketing and sales costs, increase market share, achieve more rapid adoption of new products and increase significantly the firm’s return on investment.

To learn more about Foundational Marketing call the QMP Group at 503.318.2696, email us at qmp1@qmpassociates.com or connect with us through our Contact Us page where you can detail your challenges.

*******